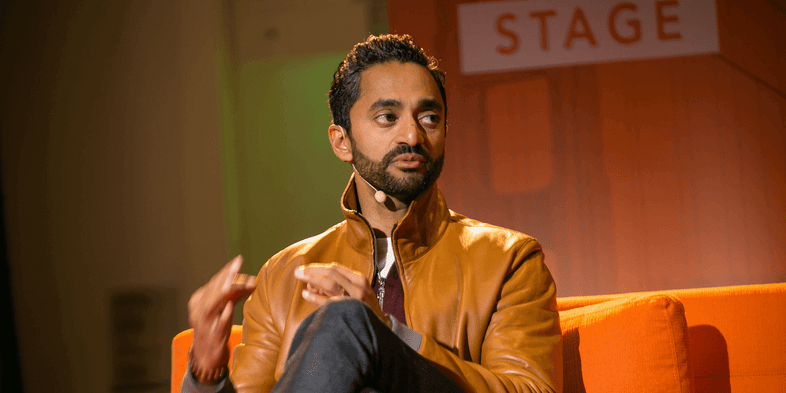

Billionaire Venture Capitalist Chamath Palihapitiya Says Bitcoin Has Already Replaced Gold

by Best Owie · · 2 minute read

The gold versus bitcoin debate has been pushed to the forefront since the crypto made its way into the purview of the general public. Since then, bitcoin has consistently outperformed while gold has mostly seen negative returns. This put bitcoin as a leading store of value ahead of the ancient store of value. Bitcoin’s performance has now solidified its usefulness over gold both as a store of value and as a hedge against inflation.

Leading investors are now clamoring for exposure to the digital asset. And latest in the lineup to reveal their interest in the digital asset is venture capitalist Chamath Palihapitiya. Palihapitiya is well known for his involvement in the SPAC space which had earned him the nickname of “SPAC King”. But as the SPAC space has slowed down, Palihapitiya seems to have turned his attention to cryptocurrencies.

Confident In Bitcoin Growth

Palihapitiya was on CNBC’s Delivering Alpha, where he opened up about investment options he had been exploring. The billionaire revealed that bitcoin had outgrown and taken over gold, which he said, “I can confidently say that bitcoin, I think, has effectively replaced gold.” The inability of the government to control bitcoin plays into Palihapitiya’s belief in the future growth of the asset.

Palihapitiya had earlier placed bitcoin price at \$200,000 in the next five to 10 years. But when asked by the show host about current price predictions, the billionaire declined to comment on it. Furthermore, Palihapitiya had also declined to comment on his current NFT holdings. A portfolio he had revealed earlier in the year that he had been building. Mostly limiting comments about the crypto market to bitcoin.

The venture capitalist also expressed concern for the space, due to the amount of money that has gone into the market and how the market will perform in light of this. “I do worry that we’ve pumped an enormous amount of money in the ecosystem and it has to show itself. When we start to balkanize these supply chains and regionalize, because of China, prices are going to go up,” Palihapitiya said.

Hedging For Inflation

The “SPAC King” also touched on inflation concerns in the economy. He opened up that he was taking three avenues to combat growing inflation. These included hypergrowth companies like the SPACs which he gained notoriety for. In addition, Palihapitiya said he was also invested in cash-generative assets and non-correlated assets.

Expounding further on this, the billionaire said that non-correlated assets like bitcoin, Ethereum, and Solana, with their booming decentralized finance (DeFi) ecosystems, present a “great counterintuitive hedge” for the first two hedges against inflation.

Speaking to his hedging options, he expressed that the best way was to invest in assets that grew the fastest and not conservative investment options with a small margin of growth. “You’ll want the thing that was generating a ton of cash because, in a rising rate environment, that has very positive attributes that work in your favor.,” the billionaire added.